From rounding up your spare change to investing in fractional shares of stock for just $1, The Ways To Wealth’s list of best micro-investing apps can help you decide on the app that’s going to help you accomplish your financial goals.

What Is Micro-Investing?

Micro-investing is investing small amounts of money (often automatically) into the stock market. This isn’t to be confused with micro-savings, which is the process of saving small amounts of money in short-term investments like a high-yield savings account.

A decade ago, investing $1 in the stock market was impossible because of high fees, which often ran between $5 and $10 per trade. But today, many companies offer commission-free trading, which makes it possible to invest very small amounts into the market.

There are many ways to make these micro-investments. Some apps help you round-up your purchases, investing your “spare change.” Others help you automatically deposit $1 a day.

Best Micro-Investing Apps

| Best For | App | IRA | Fees |

| Round-ups: | Acorns | Yes | $3 to $12 per month |

| Long-term investors: | Betterment | Yes | $4 per month or 0.25% |

| Socially-responsible investing: | Betterment | Yes | $4 per month or 0.25% |

| Buying individual stocks: | Public | No | None |

| Micro-savings: | Qapital | No | $3 to $12 per month |

Best Round-Ups App: Acorns

Acorns is a micro-investing app that helps you get started with investing via two main features (as described below).

The most popular feature of Acorns is called Round-Ups. To use it, you simply link your debit and credit cards. When you make a purchase with those cards, Acorns automatically rounds up your spare change and invests it into an Acorns Smart Portfolio — a low-cost portfolio designed around your investment goals.

Acorns also has a feature called Acorns Earn, which offers a percentage back for shopping at participating stores. When you earn this cash-back, the funds are automatically added to your portfolio.

The company has partnered with hundreds of retailers for Acorns Earn, so you won’t have trouble finding brands you shop with. Percentages usually range from 2% to 10%, which is a nice bonus for buying items you were going to purchase anyway.

Both Round-Ups and Acorns Earn go into your investment portfolio. Acorns gives you an automated system to begin investing right away, regardless of your income or experience.

Pros: The Acorns app gives you the ability to adjust your investment portfolio to meet your specific financial goals. You can choose your acceptable level of risk, your investment, and a few other criteria.

Cons: The $3 per month minimum fee can eat away at your returns, especially for small accounts.

Fees: Acorns offers three plans with flat fees: Bronze ($3), Silver ($6), and Gold ($12). Bronze includes basic brokerage accounts, Silver adds an IRA and expert Q&As, and Gold is designed for you and your family, offering the full suite of saving and investing tools.

Minimums: There is no minimum to open an account, but $5 is required to start investing.

Learn about the latest Acorns promotional offers and sign up for Acorns.

Best For Long-Term Retirement Investing and Socially Responsible Investing: Betterment

Betterment is a robo-advisor that offers the ability to invest your money in a selection of curated portfolios — comprised of a mix of exchange-traded funds (ETFs) and bonds — based on your investing goals.

You can get started with as little as $1.

Investing accounts cost $4 per month as a base price. You can then eliminate the monthly fee, and instead pay 0.25% on your investment account balance, by either setting up recurring deposits totaling $250 or more, or by having a balance of $20,000 or more across all your Betterment accounts (including Cash Reserve, checking and crypto).

Getting started with Betterment is quick and exceptionally easy, even if you’re a beginning investor with zero knowledge of how markets work. Utilizing Betterment’s recommendations will have you invested in a professionally-designed and diversified portfolio within minutes, regardless of your initial investment amount.

And because the fee is based on a percentage of your portfolio (rather than a set monthly fee), you can grow on the platform without having to worry about account expenses eating up your returns.

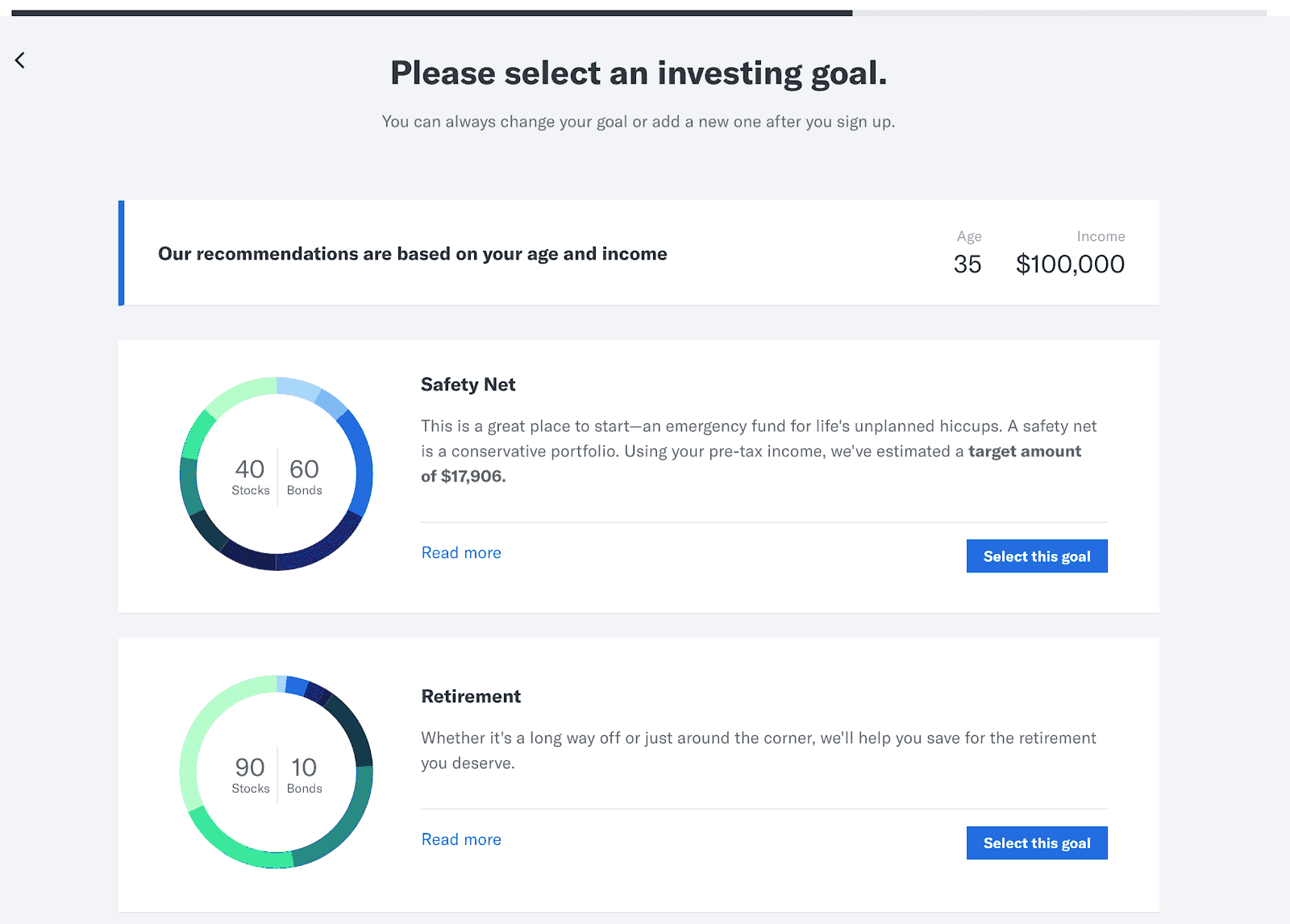

Currently, there are four pre-configured portfolios, which are designed to meet specific personal finance goals.

- Safety Net: A conservative allocation that holds a high proportion of bonds. This portfolio is designed to grow faster than the rate of inflation and is built to weather market declines, but it will likely appreciate in value slower than a portfolio that utilizes a more aggressive approach.

- Smart Saver: A low-risk, high-yield investment account that’s designed to look and function like a savings account. Smart Saver has a 100% bond allocation split between 80% U.S. government bonds and 20% low-volatility corporate bonds, making it a relatively safe place to hold cash. Smart Saver also features an automated savings function that analyzes your spending habits and expenses and automatically moves funds from your checking account. This is the account I’d choose when focusing on goals like saving for a down payment on a house.

- General Investing: Betterment labels this goal as its “utility” portfolio, because it doesn’t have a specific age marker or withdrawal date baked into the allocation (as does the Retirement plan discussed below). Depending on your age, the portfolio starts out with a relatively high proportion of stocks that tapers off over time. This portfolio is designed to build wealth over the long-term, but not necessarily to produce a source of withdrawable income at a specific date in the future.

- Retirement: Betterment’s retirement portfolio takes your age into consideration when determining your asset allocation. For a 35-year-old, that allocation would start out at 90% stocks and 10% bonds in order to maximize growth potential. As you get older, the robo-advisor continuously adjusts that allocation to reduce your risk. By the age of 65, your proportion of stock holdings would be tapered all the way down to 56%.

The logic behind this is that a person who is 20 or 30 years away from retirement is in a position to withstand a loss of portfolio value that might result from a short-term economic downturn (like a recession). On the other hand, someone closer to retirement needs certainty that they’ll be able to draw funds from their investment account to live off of in the near future, and thus has less tolerance for risk.

When you first join the platform, you’ll be asked a series of simple questions:

- Are you currently retired?

- How old are you?

- What is your annual pre-tax income?

Betterment will then suggest one or more of these four portfolios based on your answers (as shown in the screenshot below).

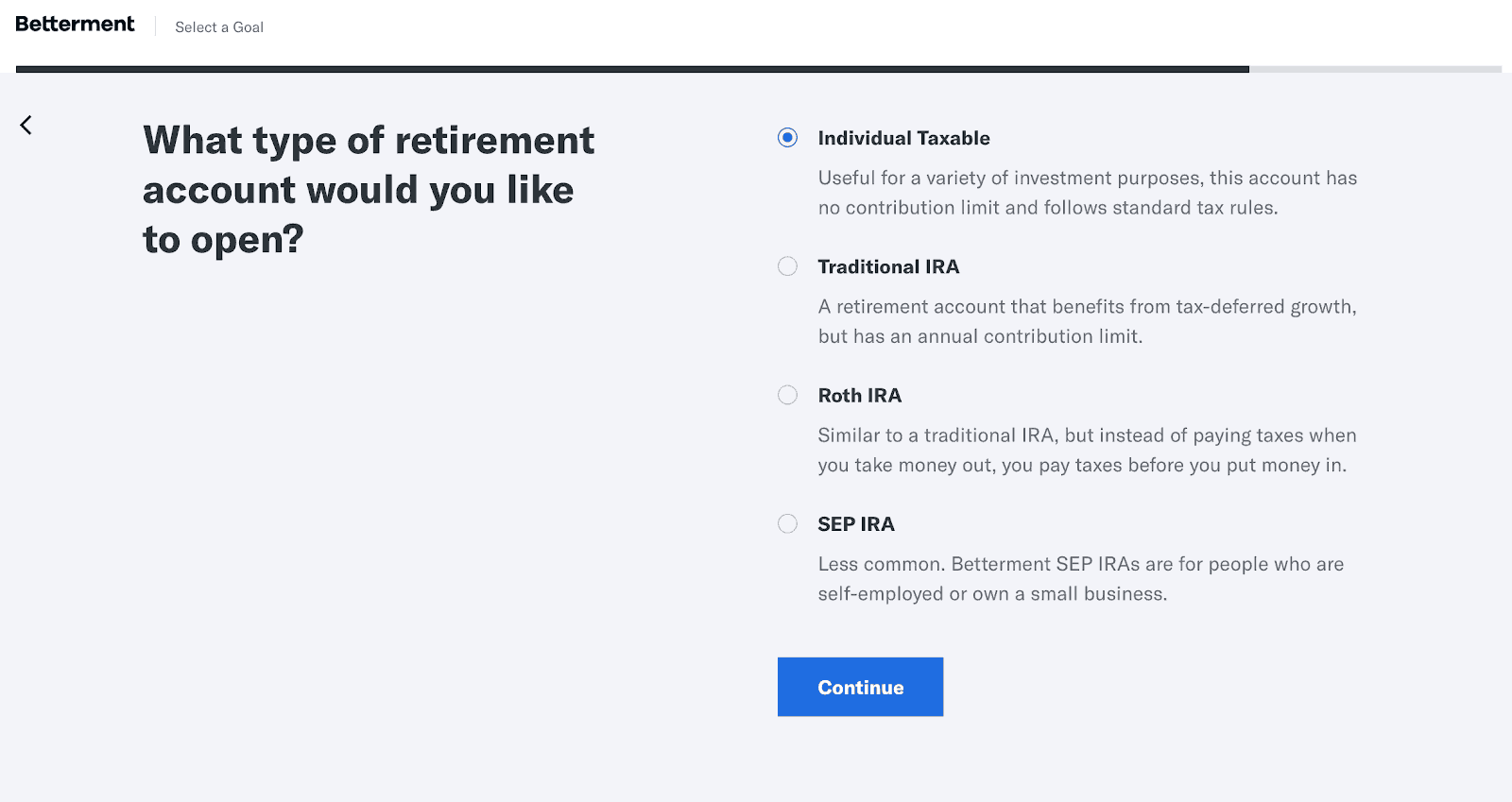

While all of them are decent options, Betterment truly shines as a retirement platform, as it offers both a taxable account and three different IRAs:

Betterment also offers a handful of other portfolio options:

- Socially Responsible Investing: Avoids investing in companies that earn profit by degrading the environment, harming the health of people or animals, or exploiting poor labor standards in developing nations.

- Goldman Sachs Smart Beta: An aggressive portfolio that aims for strong growth but accepts a greater degree of risk than the other options.

- BlackRock Target Income: A 100% bond allocation that’s designed to provide a source of cash flow during retirement while limiting exposure to market volatility.

- Flexible Portfolios: Rather than sticking to Betterment’s exact asset allocations, you have the option to adjust your allocations based on your personal preferences.

Pros: A wide variety of pre-configured options to choose from, including a high-yield forced-savings account and a smart retirement-planning algorithm that takes your age into consideration when determining your asset allocation.

Cons: You aren’t able to invest in individual stocks — although you’re better off utilizing Betterment’s portfolios anyway, as beating the market is next to impossible.

Fees: Pay $4 per month, or pay an annual price of 0.25% on your balance by either setting up recurring deposits of $250 or more or having a balance of $20,000 or more across all your Betterment accounts.

Minimums: No deposit or account balance minimum for the basic plan, but you need at least $100,000 to qualify for the premium offering.

Learn more and sign up for Betterment.

Best Micro-Investing App For Investing In Individual Stocks: Public

Public is a commission-free stock and ETF trading app for beginners with the option to buy fractional shares starting at $1. It’s best for those looking to consistently invest small amounts in the stock market, such as buying $5 worth of stock on the first of every month.

Public distinguishes itself from other commission-free trading platforms through social networking features. Most users of the app enable public sharing of their portfolio (with specific dollar amounts omitted). It’s here you can take part in their active community of investors.

If you’re going to invest in individual stocks, you can read our stock investing guide. In short, know that trying to outperform the market via individual shares of stock isn’t a viable long-term or retirement investment strategy. As such, you’ll want to limit the amount you invest with this strategy, and at the same time, have a long-term plan for saving what’s needed for retirement.

Pros: Public stands out for it’s simple and easy-to-use app, along with allowing you to purchase fractional shares of stock starting at $1. You get a free stock, up to $70 in value, for opening an account. (See more ways to get free stock.)

Cons: Public doesn’t have an IRA available and only offers taxable accounts.

Fees: No commission or account fees.

Minimums: $1 to start investing.

Learn more about Public by reading our in-depth Public review.

Best Micro-Savings App: Qapital

Qapital is a micro saving and investing app that helps you save money through various rules and goals. In Qapital parlance, goals are what you’re trying to save for. At the same time, Qapital allows you to create virtually any rule to save toward those goals, and it then triggers an action when that event happens.

Some of the preconfigured rules include round-ups, which (similarly to Acorns) send spare change to your savings account, and the “set and forget it” rule, where money automatically transfers toward a goal at predetermined intervals. If you don’t like the preset rules, you can customize your own.

Qapital also offers the ability to invest in a selection of pre-configured portfolios, which are based on modern portfolio theory (mean-variance analysis) — a mathematical way to match your investment goals (i.e., your timeline and desired return) with your risk tolerance level.

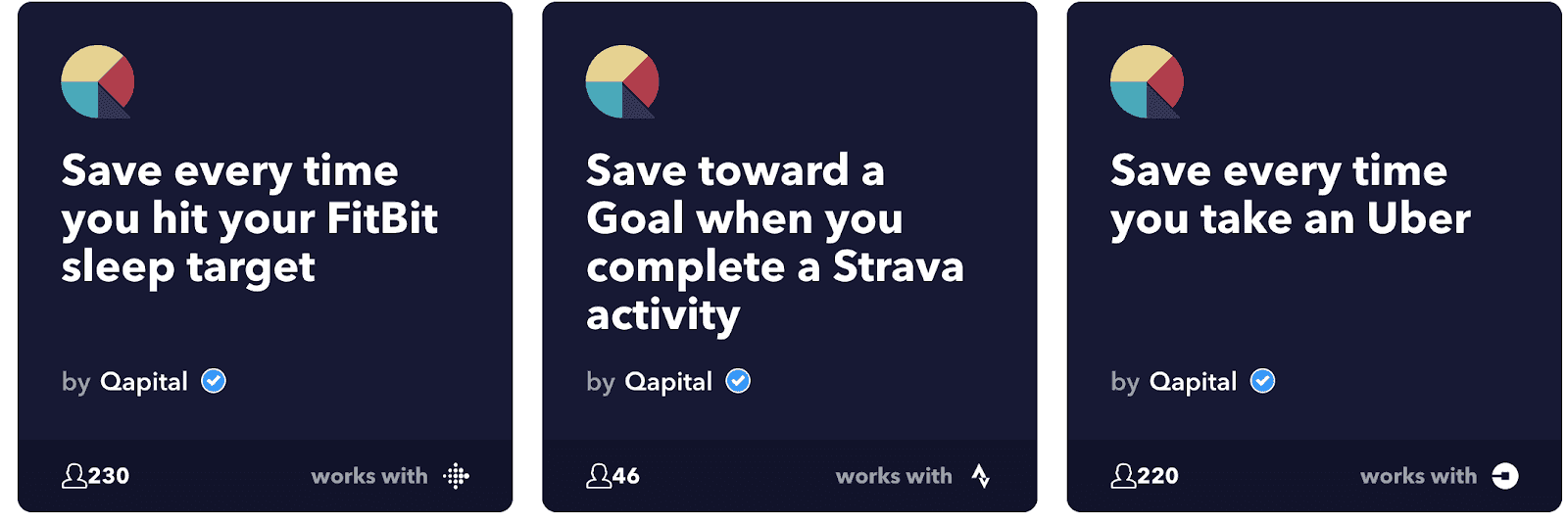

Pros: Qapital has an “If this, then that” rule that allows you to get creative when saving for short-term goals. For example, you could create a rule that says, “every time I tweet, make a $1 deposit into my savings account.” Or it could be something practical like, “every time I deposit a check, set aside 15% for taxes.” There are few limitations to the IFTTT rule.

Here are just a few examples Qapital suggests:

Cons: The fees are on the high side, especially for those not taking advantage of every feature the platform has to offer.

Fees: Qapital has three pricing tiers. Plans begin at $3 for Basic, $6 for Complete and $12 for Master.

Minimums: There is no minimum balance requirement to use Qapital.

Learn more and sign up for Qapital.

Our Top Picks At A Glance

| Acorns | Betterment | Public | Qapital | |

| Monthly fee: | $3 to $5 | $4 | $0 | $3 to $12 |

| Account minimum: | $0 | $0 | $0 | $10 |

| SIPC Insurance: | Yes | Yes | Yes | Yes |

| Checking account with debit card: | Yes | Yes | No | Yes |

| Savings account interest rate: | 1% | 3.75% | N/A | N/A |

| Individual stock investing: | No | No | Yes | No |

| Investment options: | Pre-built portfolios | Pre-built portfolios | Stocks, ETFs and crypto | Pre-built portfolios |

| Traditional and Roth IRAs: | Yes | Yes | No | Yes |

| Automatic tax-loss harvesting: | No | Yes | No | No |

| Cryptocurrency: | Bitcoin ETFs | Managed crypto portfolios | Yes | No |

Final Thoughts on the Best Micro-Investing Apps

Micro-investing apps can be one of the better ways to invest in stocks as a beginner.

That’s especially true if you’re working with limited income, such as investing with a $50,000 per-year salary (i.e., around the U.S. median income), or are investing small amounts like $50 per month.

Just make sure to actually use the app, as the small fees can really add up if you’re not actively growing your account.

If you’re just starting out, read our guide on how to start investing to learn what it takes to become a successful long-term investor.